#Retirement

Retirement Planning Blogs

Retirement Planning Blogs

Recent Articles

#retirement-planning

The average retirement age in India is between 58 and 60 years. However, this needs to evolve and should be updated to meet the growing demands of India's ageing population.

Understanding the latest retirement age in India and how it differs across sectors is helpful for employees planning their long-term financial stability. Let’s understand in detail

Continue ReadingUnderstanding the latest retirement age in India and how it differs across sectors is helpful for employees planning their long-term financial stability. Let’s understand in detail

#retirement-planning

The Government of India currently offers a broad range of of pension schemes that can provide support various groups of disadvantaged individuals. One such scheme is the Viklang Pension Yojana, which provides regular income to disabled Indian citizens. Keep reading to learn about the eligibility criteria, documents required, application procedure, etc., of the Viklang Pension Yojana.

Continue Reading#retirement-planning

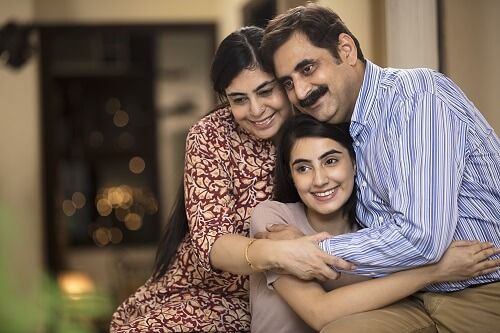

At a younger age, most of us do not think of retirement planning as a financial priority. But, as you approach the age of retirement, you may find yourself hurrying to save enough money for it. It is in your best interest to create an efficient financial plan today by finding the type of pension plan suitable to you.

Continue Reading#retirement-planning

A successful career is a stepping stone to a comfortable retirement after you turn 60. However, with a smart savings habit, you can build a corpus and actually retire by 40. This entails developing financial independence by 40 to live the rest of your life without worrying about income and expenses. Wondering how? Keep scrolling for a detailed guide!

Continue Reading#retirement-planning

Who does not want a comfortable retirement! For many, a ₹50,000 pension per month can mean living a retirement life with all the basic comforts. It is enough to meet basic living expenses, medical needs, and lifestyle costs in current times for those who choose to live a lean retirement.

Through this guide, we will help you understand how to get ₹50,000 pension per month with careful planning and an investment mindset.

Continue ReadingThrough this guide, we will help you understand how to get ₹50,000 pension per month with careful planning and an investment mindset.

Showing page 1 of 13

Popular Articles

Most Popular Article

Continue reading Popular ArticlesView All Articles

#Retirement

#Retirement

#Retirement

#Retirement

Videos for You