- Home>

- Blog>

- Tax-Savings>

- TDS on Property

Trust of 20+ Years in Industry

Written byAbhishek Chakravarti

Taxation & Finance Writer

Published 26th November 2025

Reviewed byAlok Mishra

Last Modified 2nd February 2026

Taxation & Finance Expert

What is Property Tax?

Property Tax, also known as House Tax, is the tax levied on real estate owners by the authorities such as a municipality or municipal corporation. It is used for maintenance and running of the local public amenities of the area, such as roads, sewage system, parks, lighting, and other infrastructure services.

It is levied usually on all real estate properties, including buildings whether residential or commercial, attached land, and improvements made to the property, but not on vacant plots of land with no adjoining building.

These taxes usually calculated on the value of the property owned as well as the land.

The different property divisions include:

1. Land – in its most secure form, without any construction or upgrading.

2. Improvements made to land - this includes immovable manmade creations like buildings and go downs.

3. Personal property – This includes movable manmade objects like cranes, cars, or buses.

4. Intangible property

Calculate your Income Tax

Basic Details

Income Details

Deductions

Tax Paid

Overall Summary

Net Tax payable

₹ 0

Gross Income

₹ 0

Standard Deduction

₹ 0

Total Deduction

₹ 0

Taxable Income

₹ 0

Tax Payable

₹ 0

Taxes Already Paid

₹ 0

Net Tax Payable

₹ 0

Congratulations!

You have no tax liability.

Recommended Plan for you

Create wealth for your and your family’s future goals

With Axis Max Life Investment Plans

- 100% Guaranteed returns*#

- Save tax up to Rs. 46,800##

What is Section 194IA of The IT Act?

Section 194IA of the Income Tax Act. 1961 specifies the rules regarding TDS deduction on sale of immovable property. Below are some key pointers to consider:

- Section 194IA specifies that TDS on property must be deducted if the value of the immovable property sold exceeds ₹50 lakh.

- TDS on property, as the name implies, is a tax deducted at the source on the income received by the seller of a property.

- The buyer of immovable property that costs more than ₹50 lakhs is required to deduct TDS on property before paying the seller.

- The rate of TDS on property u/s Section 194IA is 1% of the sale price of the property.

- The amount deducted as TDS by the buyer has to be directly deposited with tax authorities along with key details of the seller such as Name, Address and PAN.

- Section 194IA further specifies that the seller is eligible to claim the deducted TDS on property at the time of filing returns.

Requirements of Section 194IA

Below are some of the key requirements that need to be met in order to be eligible for TDS on Property deduction under Section 194IA:

1) TDS on property is to be deducted by the buyer and not the seller.

2) There are no TDS applicable under Section 194IA if the transaction is worth less than Rs.50 lakh.

3) TDS on property must be paid on the full amount of sale and not only the sum above Rs.50 lakh. For instance, if you buy a property with a value Rs.70 lakhs, TDS will be calculated on Rs.70 lakh and not Rs.20 lakh.

4) For payment made in instalments, TDS will be deducted on each instalment.

5) Since September 2019, payments such as club membership, car parking, advance fees, maintenance fees, electricity fees have also been comprised under 'consideration for immovable property'. It implies that such charges attached to the property will also be included in the taxable total.

6) PAN cards of both buyer and seller are mandatory for TDS on property deduction under Section 194IA.

7) If the buyer does not obtain the seller's PAN, the rate of TDS rises to 20%.

8) The TDS on the immovable property must be paid using Form 26QB in 30 days from the end of the month when the TDS was deducted.

9) The buyer is required to obtain Form 16B and issues the form to the seller.

TDS on Purchase of Property

a)To keep a check on the extensive use of black money in immovable property transactions, the government of India has introduced a law, where the purchaser of a property has to deduct tax at source, i.e. TDS on property while paying the seller for his property.

b)Under Section 194IA of Income Tax Act, a buyer is required to deduct TDS at the rate of 1% of the sale consideration. This is applicable if the value of the payment is Rs.50 lakh or more.

c) The Section covers residential property, commercial property, as well as land. You must note that transactions relating to the purchase of agricultural land are not covered under this provision.

Now the question arises when to deduct the TDS on property purchase? The purchaser is required to deduct TDS on property at the time of crediting the amount to seller’s account or time of payment, whichever is earlier.

How to Claim TDS on Sale of Property?

a) From 1 June 2013, when a buyer buys immovable property (i.e. a building or part of a building or any land except agricultural land) costing more than Rs.50 lakh, he must deduct tax at source (TDS) when he pays the seller.

b) This has been laid out in Section 194IA of the Income Tax Act.

c) The buyer obtains Form 16B and issues the form to the seller.

The property seller has to do the following:

1) Provide PAN to the buyer who in turn will fill-up the form online and submit to the Income Tax Department for TDS.

2) Verify that the property buyer has deposited the taxes deducted from sale consideration and should be reflecting in the Form 26AS Annual Tax Statement.

3) Get the Form16B for paying the TDS.

What is Form 26QB?

Form 26QB is a challan cum statement that need to be submitted to tax authorities by the buyer of an immovable property under provisions of Section 194 IA. This form can currently be accessed by logging into the Income Tax e-Filing portal.

Some key considerations regarding submission of Form 26 QB include:

- Submission of Form 26QB and TDS on property payment must be made within 30 days of purchase of the property

- Payment of TDS on property using Form 26QB can be made using both online and offline methods.

- Acceptable online payment methods for TDS on property payments include Net banking, debit card, RTGS/NEFT, etc

- In order to pay TDS on property offline using Form 26QB can be paid at counters of designated Indian banks.

After successful payment of TDS using Form 26QB, the details of the payment can be double checked by the buyer in Form 16B. Details of TDS on property payments typically get updated in Form 16B within 5 days of the TDS payment. A copy of the downloaded Form 16B should be shared with the seller as proof of TDS payment for the property sale.

How to File TDS on Property (Form 26QB)?

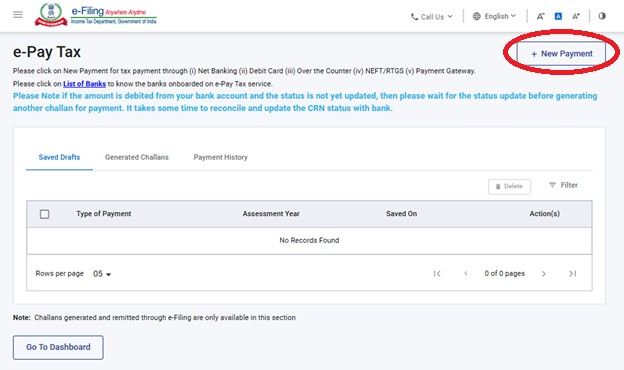

Step 1: Log into your e-filing account. Navigate to the “e-Pay Tax” link and then click on “New Payment”

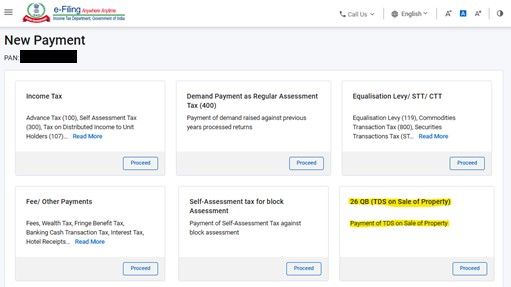

Step 2: On the subsequent page, go to the 26 QB (TDS on Sale of Property) tab and click on “Proceed”.

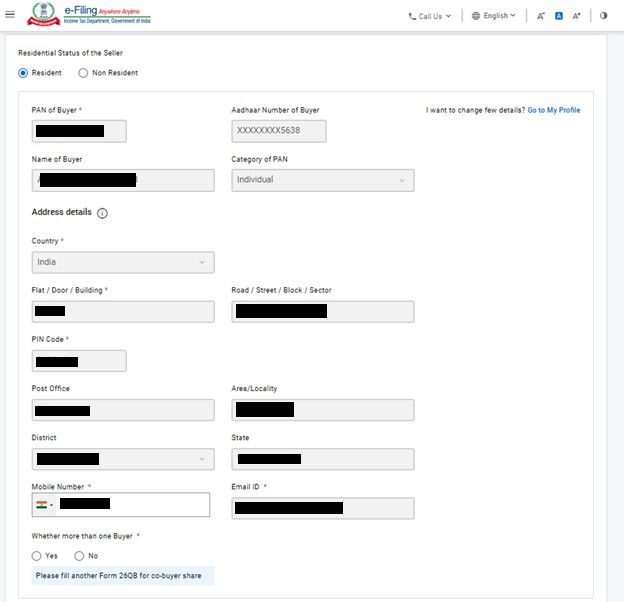

Step 3: Next fill out the applicable fields in the Seller Form as shown below.

Step 4: Next provide details regarding the mode of payment, such as – NEFT/RTGS, Net Banking, Debit Card, etc.

Step 5: Once the payment has been made successfully, a challan is automatically generated. The challan can be used as proof of payment and will contains key details such as CIN, payment amount, etc. It is good practice to download and retain a copy of this in case, it is required in the future.

TDS on Property Rent

Section 194-IA is applicable only in cases where an eligible property is sold. There is a related Section 194IB, which is applicable in case of rental properties. This is because, rental income is considered as income for the landlord, so is subject to income tax, if it exceeds a specific limit.

As per provisions of Section 194-IB, TDS on rent is applicable if monthly rent exceeds ₹50,000. The TDS on property rent has to be deducted by the renter whether an individual or HUF and deposited directly with the tax authorities.

The rate of TDS on property as per current Income Tax rules is 5% of the monthly rent payable. The rent remaining after deduction of TDS is to be paid to the landlord as due rent. The renter should also provide proof of TDS on property rent deposited with the tax authorities to the landlord at specific intervals.

When to deduct the TDS on Property Rent?

a) The TDS on property needs to be deducted when the total sum of rent is received or paid in a particular financial year.

b) Both individuals and members of Hindu Undivided Family are obligated to TDS of property at 5% of the rent collected given the rent exceeds Rs.50,000 per month.

b) Both individuals and members of Hindu Undivided Family are obligated to TDS of property at 5% of the rent collected given the rent exceeds Rs.50,000 per month.

Details Required for TDS Payment

TDS on property payments can be done using the Form 26 QB. In order to make the TDS payment using this challan cum statement, the below data needs to be provided by the buyer:

- Residential Status of seller

- PAN of the seller & buyer

- Communication details of seller & buyer

- Property details

- Amount paid/credited & tax details

It must be kept in mind that Form 26QB needs to be filled out by the buyer of the property. This is because the TDS on property payment is paid directly to the tax authorities by the buyer of the property.

Penalties Applicable on Non-Filing of TDS

a) The tax amount deductible must be paid to the government within seven days of any such transaction made.

b) The penalty of not paying TDS on property can go up to Rs. 1 lakh under Section 271H.

c) To avoid any type of penalty, you must pay the TDS on property along with interest amount and any late payment fee as and when you receive a tax notice.

d) Under Section 201, you will have to pay an interest of 1% per month if the tax was not deducted at all.

e) 1.5% interest will have to be paid if the tax was deducted but not deposited with the government.

f) In case of default on account of non/late filing of Form 26QB, a fee shall be levied u/s 234E of the Act.

g) The late filing fee applicable under Section 234E is Rs. 200 per day dependent on the maximum tax due.

h) If the property seller has already paid capital gains tax, the late filing fee could be reduced or cut off altogether.

However, to avoid getting into such penalties, it is advisable to stay on track and pay all taxes on time.

Exceptions for Section 191-IA

While TDS on property u/s 194IA is applicable in the case of most property transactions, there are some key exceptions to consider. These include:

Sale of Agricultural Land

If the immovable property being transferred is designated as agricultural land, Section 194-IA is not applicable. So, TDS on property is not applicable in immovable property transactions that involve agricultural land as it is not classified as a capital asset as per current provisions of the Income Tax Act. This exception specified under Section 194-IA is applicable irrespective of the value of the agricultural land being sold.Sale of Property Less than 50 Lakh

If an immovable property transaction is valued at less than ₹50 lakh, Section 194IA is not applicable. This is because as per current rules the TDS on property u/s 194-IA is applicable only for transactions exceeding ₹50 lakh. So, in this case the buyer is not required to deduct TDS on property or deposit it with the tax authoritiesSale of Property to Government

If an immovable property is purchased by the Government for development purposes, Section 194-IA is not applicable. Such acquisitions are made for various purposes such as building of metro rail, highways, expressways, etc. and are termed as compulsory acquisition. TDS on property in such cases is applicable as per provisions of Section 194-LA which features slightly different rules.

More plans for you

FAQs About TDS on Property

What should I do as a buyer if I do not have the PAN of the seller?

The seller(s) PAN is mandatory for deducting TDS on property and filing Form 26QB. It is the buyer's responsibility to acquire the PAN from the seller(s) before effecting the transaction.

How can I file transactions of joint parties in Form 26QB?

The Form 26QB challan must be filled by each buyer for every unique buyer-seller combination for their respective share. For instance, in the case of one buyer and two sellers, two forms must be filled in. Similarly, if there are two buyers and two sellers, then four forms need to be filled.

Who will pay TDS on Property?

The buyer needs to pay TDS on property using the e-tax TDS payment option. Buyer can make the TDS payment using netbanking portal or offline by visiting the nearest bank branch. He/she will get an acknowledgement after the payment of TDS on property, which can be used to generate Form 26QB.

Can TDS on Property deducted by buyer be claimed by seller?

Yes, TDS on property is refundable. At the time of sale of property, buyer is required to deduct TDS on property and deposit the same with the government. But, the seller is allowed to avail credit of the same or claim TDS refund by filing his ITR.

Can seller claim refund of TDS on Property deducted?

Yes, property seller can claim TDS on property which is already deducted. To do so, seller can easily file the income tax return online and claim TDS refund on immovable property deducted.

What is TDS on the sale of the property?

TDS or Tax Deducted at Source is applicable to sale of property under provisions of Section 194-IA. As per current tax rules, TDS on property is applicable only in case of non-agricultural properties valued more than ₹50 lakhs.

Who is responsible for deducting TDS on the sale of the property?

The buyer of the property is responsible for deduction of TDS on property before making the payment of the remaining amount to the seller. The buyer is also responsible for transferring the TDS deducted to the tax authorities.

What is the time limit to pay TDS on a property purchase?

The TDS on property needs to be paid to the tax authorities within 30 days of the completion of the sale.

What is the rate of TDS under Section 194-IA?

Currently, the TDS rate on property sale under provisions of Section 194-IA is 1% of the selling price of the property.

How to pay TDS on property purchase?

TDS on property purchase is to be paid either online or offline using Form 26QB, a challan cum statement. Form 26QB can be accessed by logging into the Income Tax Portal.

How to pay TDS on purchase of property from NRI?

TDS on purchase of property from a non-resident Indian (NRI) is subject to provisions of Section 195. In this scenario TDS needs to be deducted irrespective of the sale price of the property.

Below are the steps to pay TDS if property is purchased from a NRI:

Step 1. The buyer needs to be obtain a TAN or Tax Deduction and Collection Account Number. This is mandatory in order to deduct TDS when purchasing an immovable property from a NRI.

Step 2. Determine the holding period of the property being sold. If the NRI has held the property for less than 24 months prior to making the sale, the TDS rate applicable is 30%. If the property has been held by the NRI for 24 months or longer prior to the sale, TDS rate will be 20%.

Step 3. The amount deducted TDS has to be deposited with tax authorities using Form 26Q. This is can be done by logging into the Income Tax e-Filing portal. Key details required for paying TDS on property using Form 26Q include details of the property, PAN and contact details of both buyer and seller, TDS paid, etc.

Step 4. Subsequently the details of the TDS deposit can be cross verified in Form 16A. The buyer should share a copy of Form 16A with the seller as proof of payment for TDS on the property purchased.

Below are the steps to pay TDS if property is purchased from a NRI:

Step 1. The buyer needs to be obtain a TAN or Tax Deduction and Collection Account Number. This is mandatory in order to deduct TDS when purchasing an immovable property from a NRI.

Step 2. Determine the holding period of the property being sold. If the NRI has held the property for less than 24 months prior to making the sale, the TDS rate applicable is 30%. If the property has been held by the NRI for 24 months or longer prior to the sale, TDS rate will be 20%.

Step 3. The amount deducted TDS has to be deposited with tax authorities using Form 26Q. This is can be done by logging into the Income Tax e-Filing portal. Key details required for paying TDS on property using Form 26Q include details of the property, PAN and contact details of both buyer and seller, TDS paid, etc.

Step 4. Subsequently the details of the TDS deposit can be cross verified in Form 16A. The buyer should share a copy of Form 16A with the seller as proof of payment for TDS on the property purchased.

ARN NO: Aug23/Bg/05M

Disclaimer:

Save 46,800## on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are:

Save 46,800## on taxes if the insurance premium amount is Rs.1.5 lakh per annum and you are:

- Regular Individual

- Fall under 30% income tax slab having taxable income less than Rs. 50 lakh

- Opt for Old tax regime

Popular Searches

Online Sales Helpline

- Whatsapp: 7428396005Send ‘Quick Help’ from your registered mobile number

- Phone: 0124 648 890009:30 AM to 06:30 PM

(Monday to Sunday except National Holidays) - service.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.

Customer Service

- Whatsapp: 7428396005Send ‘Hi’ from your registered mobile number

- 1860 120 55779:00 AM to 6:00 PM

(Monday to Saturday) - service.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.

NRI Helpdesk

- +91 11 71025900, +91 11 61329950 (Available 24X7 Monday to Sunday)

- nri.helpdesk@axismaxlife.comPlease write to us incase of any escalation/feedback/queries.