Related Articles

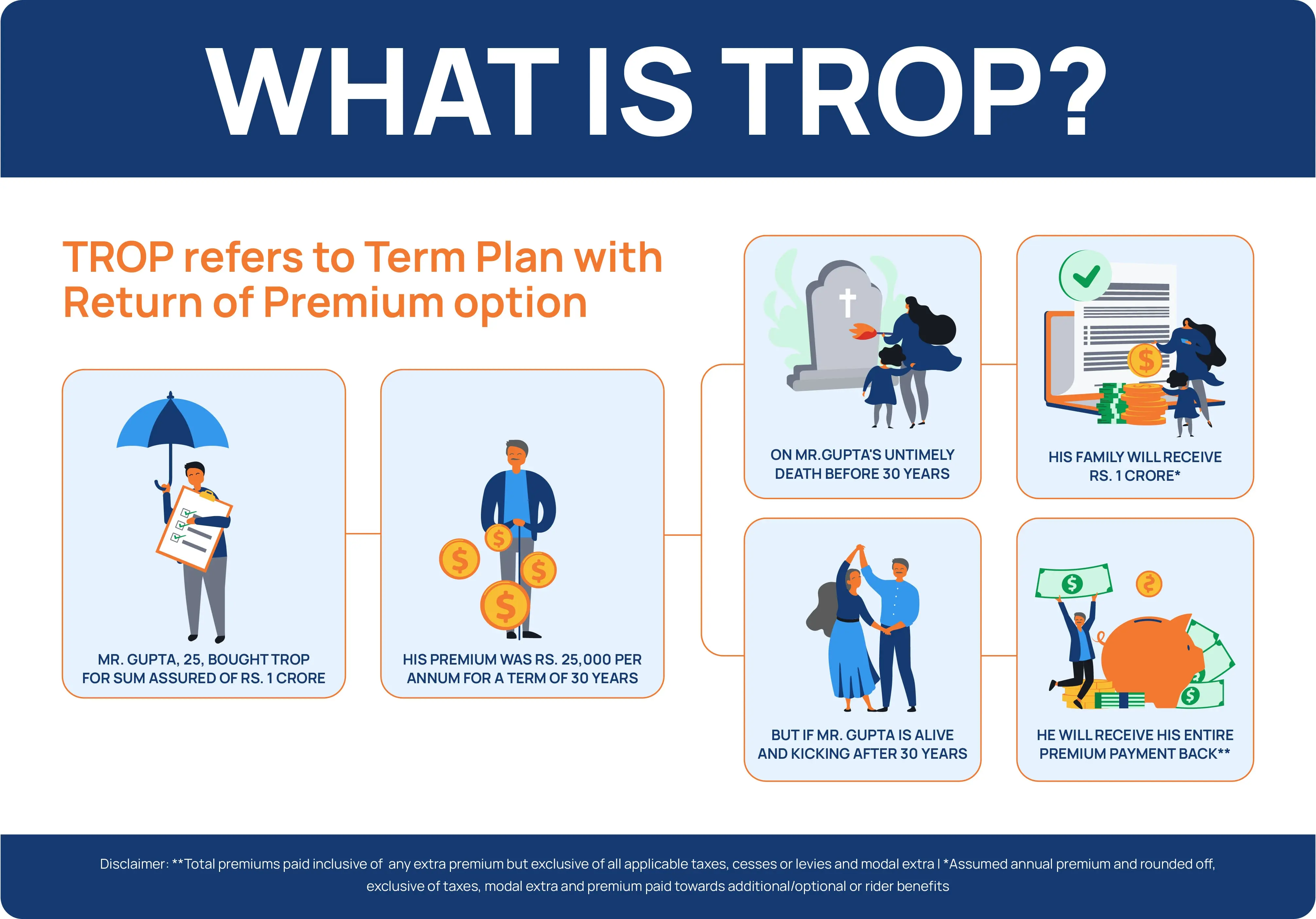

Term Insurance with Return of Premium

Term insurance is a popular choice amongst insurance buyers. It is a simple plan that offers financial coverage for a certain period. Although a basic term insurance plan can be highly beneficial for most individuals, a term insurance with a return of premium plan can offer benefits beyond that.

Read More

Top 4 Reasons Why Term Plan with Return of Premium Makes Sense

For most of us, ideal life is where we get to live out our days in the presence of our family and friends, doing things which we like. We make healthier lifestyle choices to prolong our lifespan and make sure that we are there to watch our loved ones live out their dreams and accomplish their goals in life.

Read More

What is Term Insurance?

It is a commonly held belief that term insurance should be the first step in financial planning. However, you may ask, how purchasing a term plan actually helps? To help you understand this, let’s look at what is term life insurance and how it works in detail.

Read More